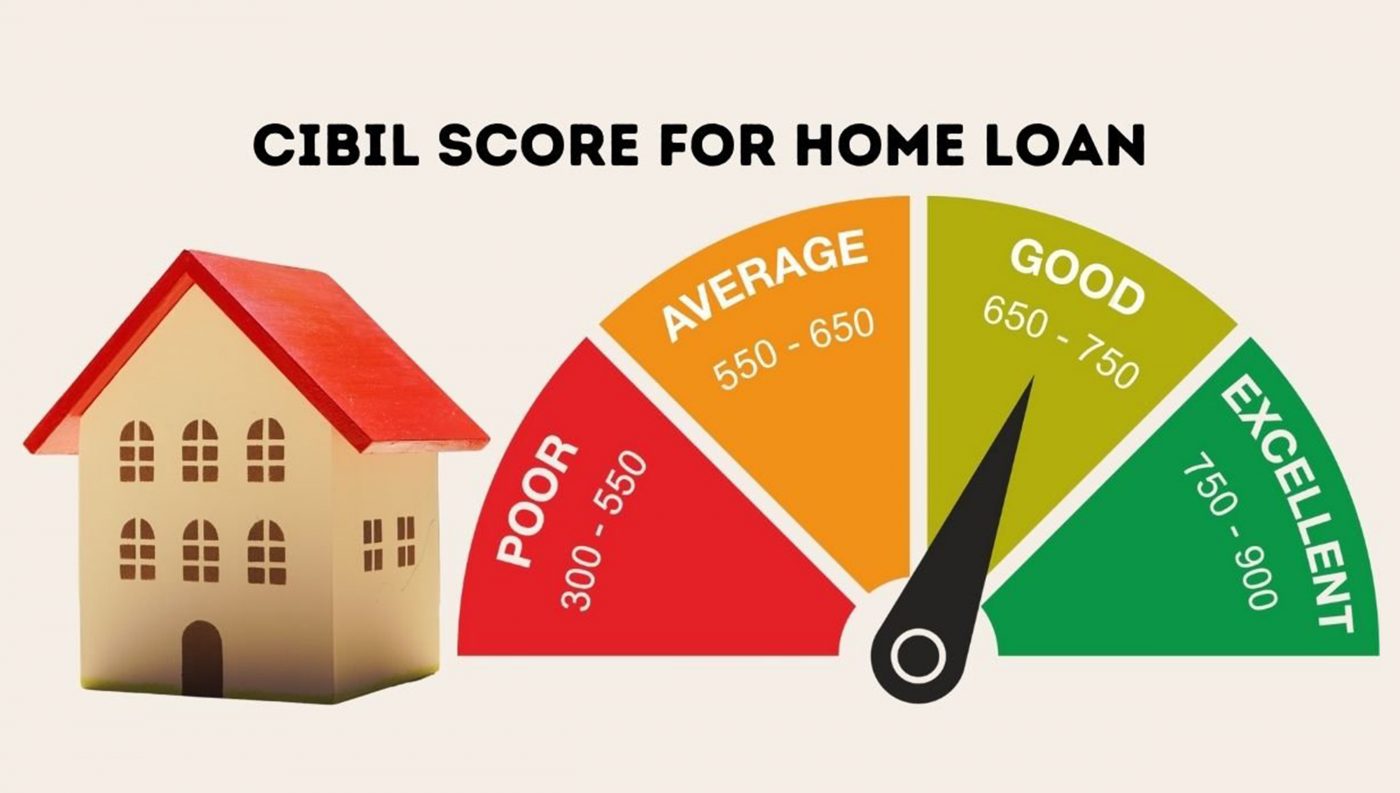

Owning a home is a dream that many people strive to achieve. It provides a sense of security, stability, and pride. But a low CIBIL score can make it challenging to obtain a home loan. In this home buying guide, we’ll explore strategies to overcome this obstacle and achieve homeownership.

Before exploring the ways to overcome a low CIBIL score, it’s essential to understand its significance. The Credit Information Bureau (India) Limited (CIBIL) score is a three-digit number that reflects an individual’s creditworthiness. Lenders rely on this score to determine the risk associated with lending money. A low CIBIL score can be a result of late payments, high credit utilization, or defaults on loans. Steps to Buying a Home with a Low CIBIL Score:

1. Improve Your Credit Score: Although it may take time, improving your credit score is a crucial step towards homeownership. Start by paying your bills on time and reducing your credit card utilization. Additionally, it’s essential to clear any outstanding debts and avoid taking on new loans. These actions will gradually improve your creditworthiness, making you a more attractive candidate for lenders in your home buying guide.

2. Look for Alternative Financing Options: While traditional lenders may be hesitant to approve a home loan with a low CIBIL score, there are alternative financing options available. Research different loan programs such as government-backed loans or seek assistance from credit unions and local housing agencies. These institutions may have more flexible eligibility criteria and be willing to consider your overall financial situation rather than solely relying on your CIBIL score. This aspect is particularly important to consider in your home buying guide.

3. Save for a Higher Down Payment: By saving more money towards the down payment, you can demonstrate your commitment and financial stability to lenders. A substantial down payment reduces the loan amount required and increases the chances of getting loan approval, even with a low CIBIL score. This step should not be overlooked in your home buying guide.

4. Seek Co-Applicants or Guarantors: Consider involving a co-applicant or a guarantor with a higher credit score to strengthen your loan application. A co-applicant shares the responsibility of loan repayment and can help increase the chances of approval. Similarly, a guarantor provides an additional layer of security for the lender, assuring them of loan repayment in case of default. This strategy is another valuable aspect to include in your home buying guide.

A low CIBIL score should not deter you from achieving your dream of owning a home. By following the strategies mentioned in this home buying guide, you can overcome the challenges associated with a low credit score. Remember, improving your credit score takes time, so be patient and persistent. With determination and the right approach, you can make your dream of homeownership a reality, regardless of your CIBIL score.